Maze Environmental applies rigorous data driven approaches to eliminate emissions from methane flaring, which simultaneously optimise well production.

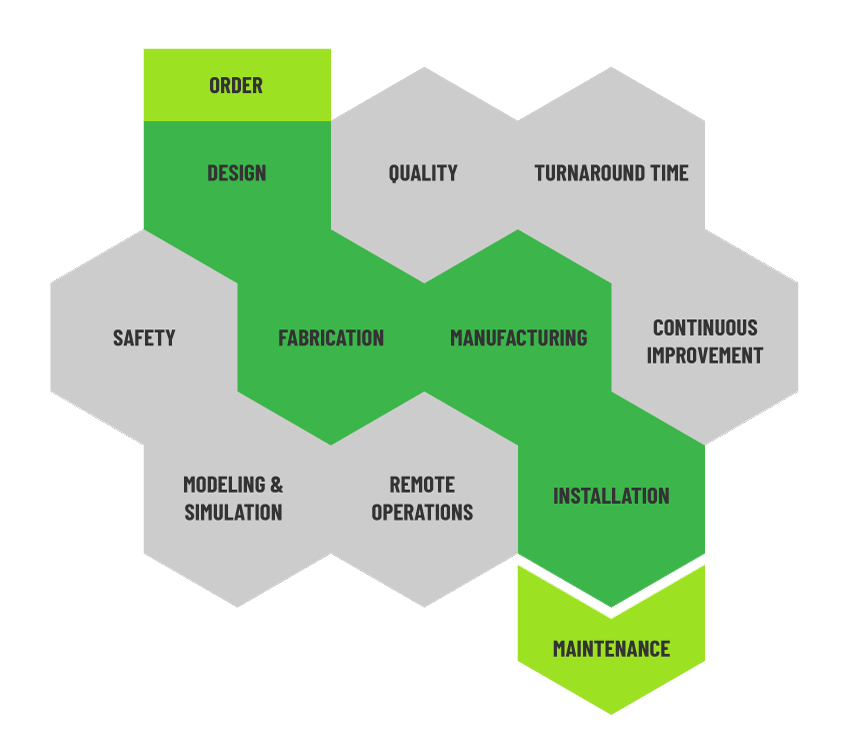

From the beginning of each project, our team works together to establish a specific strategy for each unique scope.

This provides an unmatched, full suite of decarbonisation products in the upstream and midstream sectors.

We have successfully managed hundreds of locations and executed projects on-time and on-budget for some of the world’s largest producers.

Maze Environmental provides an array of product solutions, implemented with the highest standards of engineering and design by some of the industry’s brightest minds. We manage projects from front to back with minimal disruption to operations, which results in high, short term returns on our project implementation for clients.

Brooks took his team of engineers and began designing a system to standardize the process.

He had hopes to create better cost-effective ways of doing the same job every day. His goal was not to use anything new. Everything his team designed had to be familiar and work with existing systems.

Brooks Pearce is Maze’s Chief Executive Officer and Founder, where he is responsible for project implementation, commercial client acquisition and product research & development.

Brooks is a serial entrepreneur, who co-founded a successful oil & gas equipment fabrication and well servicing company, Texas FabCo Solutions, which grew from $20 million in revenue in 2018 to $65m in revenue in 2021.

Brooks is an experienced consultant to major oil & gas companies in the USA, and has been solving complex problems for these companies for more than 25 years. His expertise ranges from reservoir pressure mapping and oil swell strategies to innovative O&G product development and scaling